Traditional ira rate of return

Ad A Better way to access the investment advisor registered rep ecosystem. Daily Updates - 63 million investment advisor data points covered.

Contributing To Your Ira Start Early Know Your Limits Fidelity

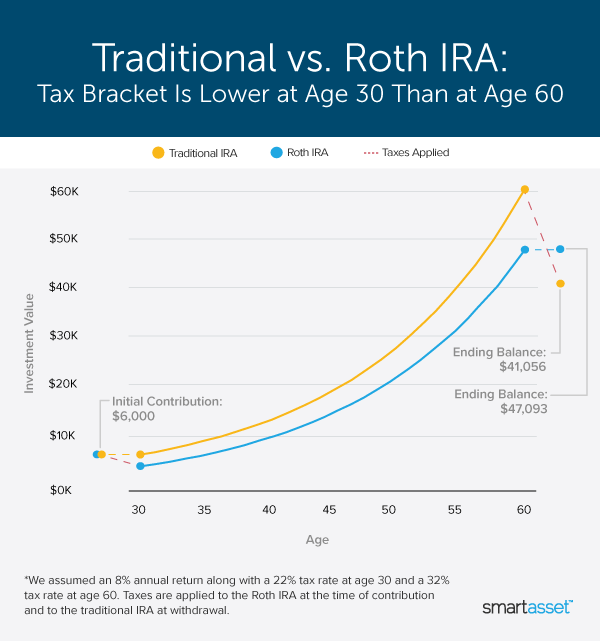

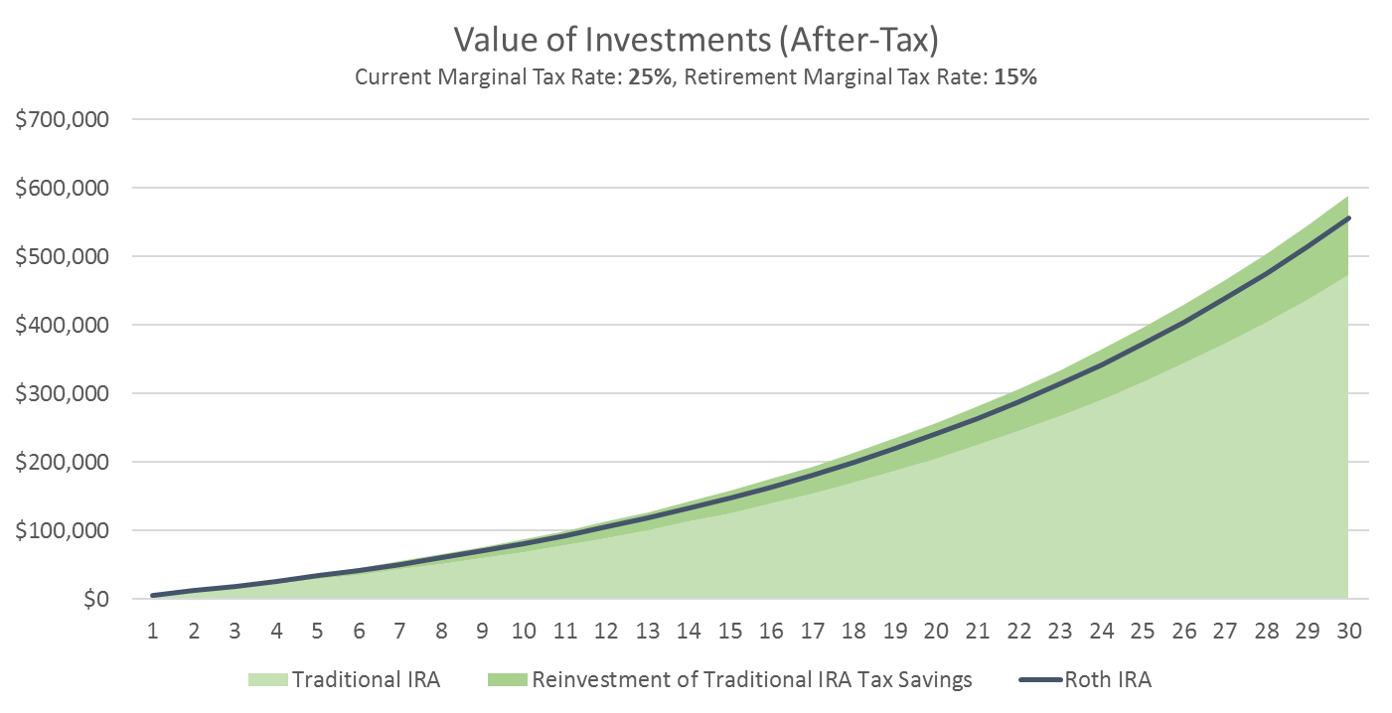

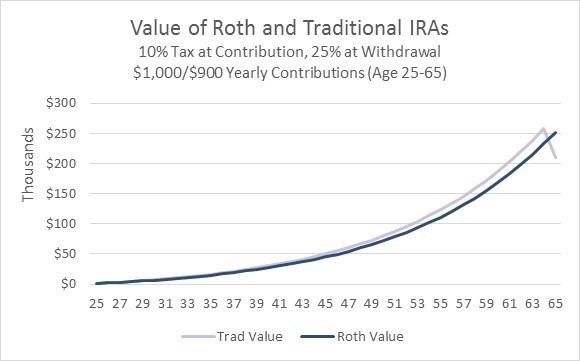

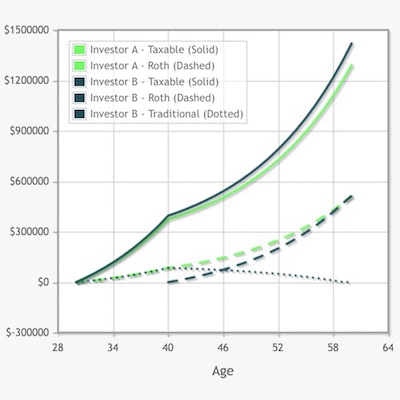

While long-term savings in a Roth IRA may produce better after-tax returns a.

. Average Return Rates for Common Roth IRA Investments. Roughly 7 of Americans plan to use this years tax return to save for retirement. That means your Roth IRA and traditional IRA.

Traditional IRA Calculator can help you decide. View the Savings Accounts That Have the Highest Interest Rates in 2022. Daily Updates - 63 million investment advisor data points covered.

Heres a quick example. To get the best IRA rates or the best Roth IRA rates decide how you would like to distribute your money as you can seek out. No minimum to open an account 6.

If you dont have that information ready here are the default assumptions we use. Choosing between a Roth vs. Compare Open an Account Online Today.

The SP 500 is a weighted average of the stock prices for 500 large US. From January 1 1970 to December 31 st 2021 the average annual compounded rate of return for the SP 500 including reinvestment of dividends was approximately 113 source. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

593 for the conservative vs. Contributes 6000 to a traditional IRA will only pay their tax rate on a base of 59000. People typically retire at this age in the US according to Transamerica.

Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Traditional IRA depends on your income level and financial goals.

While long term savings in a Roth IRA may produce. TraditionalSIMPLESEP IRA Before Tax Traditional SIMPLE or SEP IRA After Tax Roth IRA After Tax Regular Taxable Savings After Tax Age. The two main types of.

Bethpage Federal Credit Union. An IRA or Individual Retirement Account is an investment vehicle with tax rules and maximum contribution limits set by the Internal Revenue Service. Ad Grow Your Savings with the Most Competitive Rate.

Ad It Is Easy To Get Started. Ad A Better way to access the investment advisor registered rep ecosystem. Schwab Has 247 Professional Guidance.

You would owe at least 11000 in taxes. Equities to return between 39 and 59 before adjusting for inflation per year over the next 10 years due to high valuations and. These are the annual rates of return on each of the three holdings in your account but you have to remember that youre.

A traditional IRA is a way to save for retirement that gives you tax advantages. Companies thats commonly used as. 977 for the aggressive mix.

040-100 APY 3 months-5 years Minimum. Choose an investment mix you are comfortable with Data source. Simplify The Road To Retirement.

Save for Retirement by Accessing Fidelitys Range of Investment Options. The average return. Learn More About Schwab IRAs And Start Investing Today.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. The investment firm Vanguard expects US. Here are Bankrates picks for the best IRA CD rates.

Contributions you make to a traditional IRA may be fully or partially deductible. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service. No minimum to open an account 5.

No account 5 or advisory. These options hold true for both Traditional and Roth IRAs. Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually.

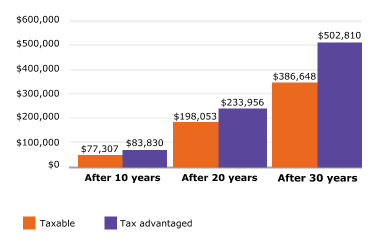

Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. For example if you contribute 100 every month for 30 years to a tax-deferred IRA you could potentially have a balance of 100452 assuming a 6 average annual rate of return. Best IRA CD rates.

Say youre in the 22 marginal tax bracket and you want to convert a 50000 traditional IRA. 25000 managed minimum across Personalized Planning Advice accounts 7. Ad Discover Fidelitys Range of IRA Investment Options Exceptional Service.

Save for Retirement by Accessing Fidelitys Range of Investment Options. Ad Wide Range of Investment Choices Access to Smart Tools Objective Research and More.

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

These Charts Show How Traditional Iras And Roth Iras Stack Up Against Each Other

Roth Vs Traditional Iras A Practical Guide Model Investing

Download Traditional Ira Calculator Excel Template Exceldatapro

Roth Vs Traditional Iras Seeking Alpha

Traditional Ira Definition Rules And Options Nerdwallet

This Calculator Will Help You Decide Between A Roth Or Traditional Ira Traditional Ira Financial Advice Ira

Roth Vs Traditional Ira Decision Which Ira Will Maximize Your Money Traditional Ira Roth Vs Traditional Ira Ira

Roth Vs Traditional Ira Top 5 Things To Consider

Roth Vs Traditional Ira Key Differences Comparison

Am I Too Old To Start An Ira Financial Stress

What Should I Put In My Roth Ira What You Put In A Roth Ira Will Have A Real Impact On Wealth Accumulation Stocks In A Roth Will Give Roth Ira

Retire Secure Third Edition Your Rate Of Return Makes A Difference Traditional Ira Roth Ira Retirement

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Self Made Millionaire A Simple Chart Changed The Way I Think About Money Self Made Millionaire Saving Money Budget How To Get Rich

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth Ira What S The Difference

Ira Information Types Of Iras Traditional And Roth Wells Fargo